Tax Checklists

Please use the below checklists to outline the key documentation and information your Accountant requires to prepare your tax return. Individual Checklist Business Checklist Superannuation

Please use the below checklists to outline the key documentation and information your Accountant requires to prepare your tax return. Individual Checklist Business Checklist Superannuation

When a loan is paid out early, it can sometimes trigger a penalty interest charge. There are circumstances where this charge can be tax deductible,

With Tax Time 2019 just around the corner, we run over the sort of substantiation that the ATO expects for work-related deductions that taxpayers claim.

The way employers report your tax and super information to the ATO is changing. This reporting change is called Single Touch Payroll (STP) and it

To claim a GST credit, a business is generally required to hold a valid tax invoice. However there can arise certain circumstances where an alternative

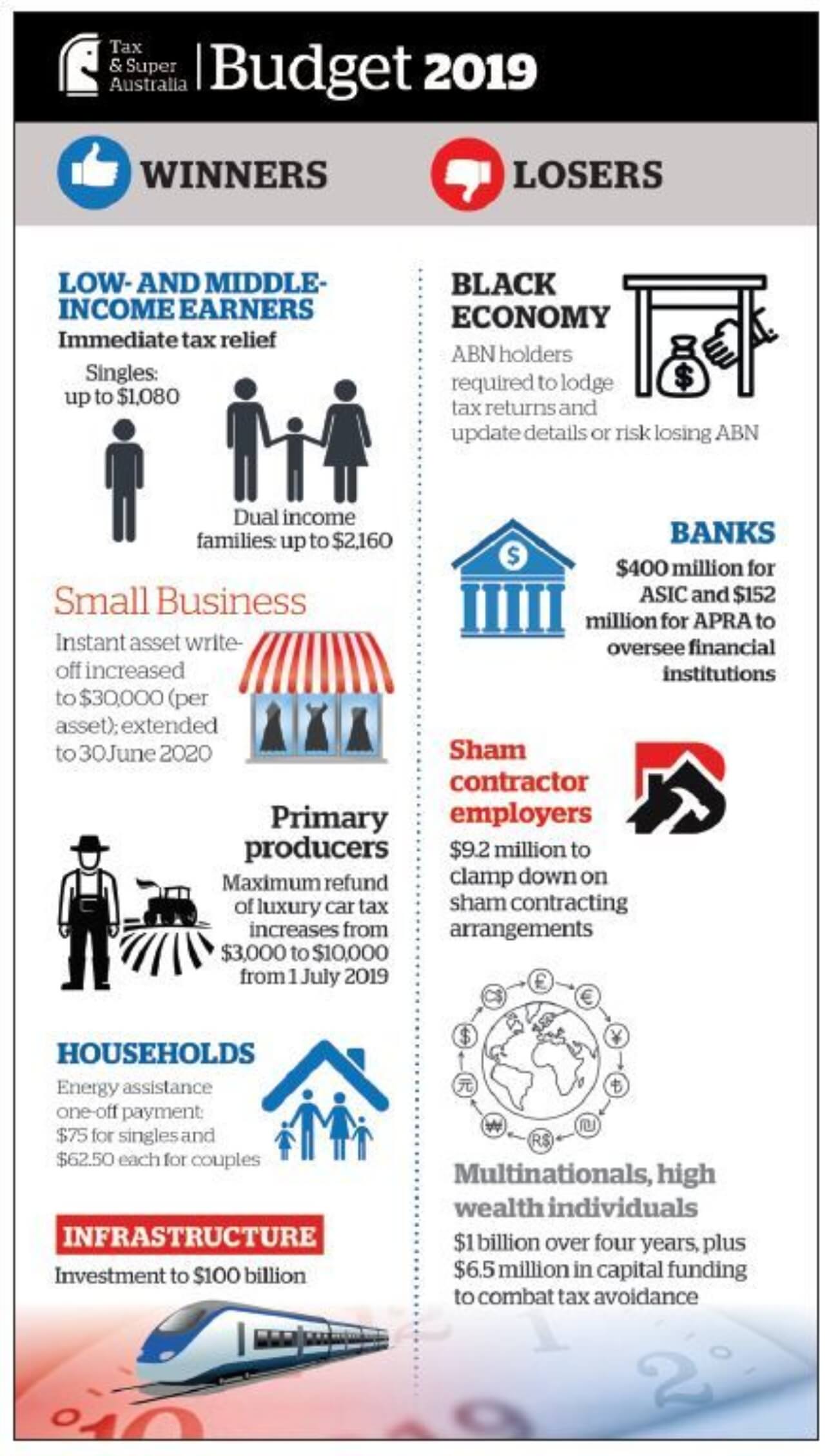

This year’s federal budget has a few sweeteners, which was to be expected with the next federal election only about a month away and the

Working from home, while always an option, has become more viable as technology has developed to enhance connectivity. The ATO is fully on-board with regard

A business facing the prospect of effectively dealing with losses could find their task a little easier with a more relaxed version of the “same

Start-up businesses are generally not for faint-hearted investors, but there are tax incentives that can help. We look at two early stage business investment options.

A recent tax case before the Federal Court serves as a reminder that a

Welcome to the December edition of our client newsletter. As the year comes to

Welcome to the November edition of our client newsletter. This month, we’ve brought together

Thinking about using your SMSF to invest in property? With the right structure, your

P.O Box 121

Mount Eliza

VIC 3930

P.O Box 121

Mount Eliza

VIC 3930