A Warning About COVID-19 Online Scams

During this scary and stressful time we ask that you be very careful opening any emails and attachments you receive. Recently there has been a

During this scary and stressful time we ask that you be very careful opening any emails and attachments you receive. Recently there has been a

The Government is introducing a subsidy program to support employees and businesses. The JobKeeper Payment is designed to help businesses affected by the Coronavirus to

By now we are all well aware of the coronavirus (COVID-19) and the impact this will have on our daily operations. Our client’s and staff’s

Sometimes small business owners pass up the at-times lucrative small business CGT concessions simply through not knowing that they are eligible to claim them. Answering

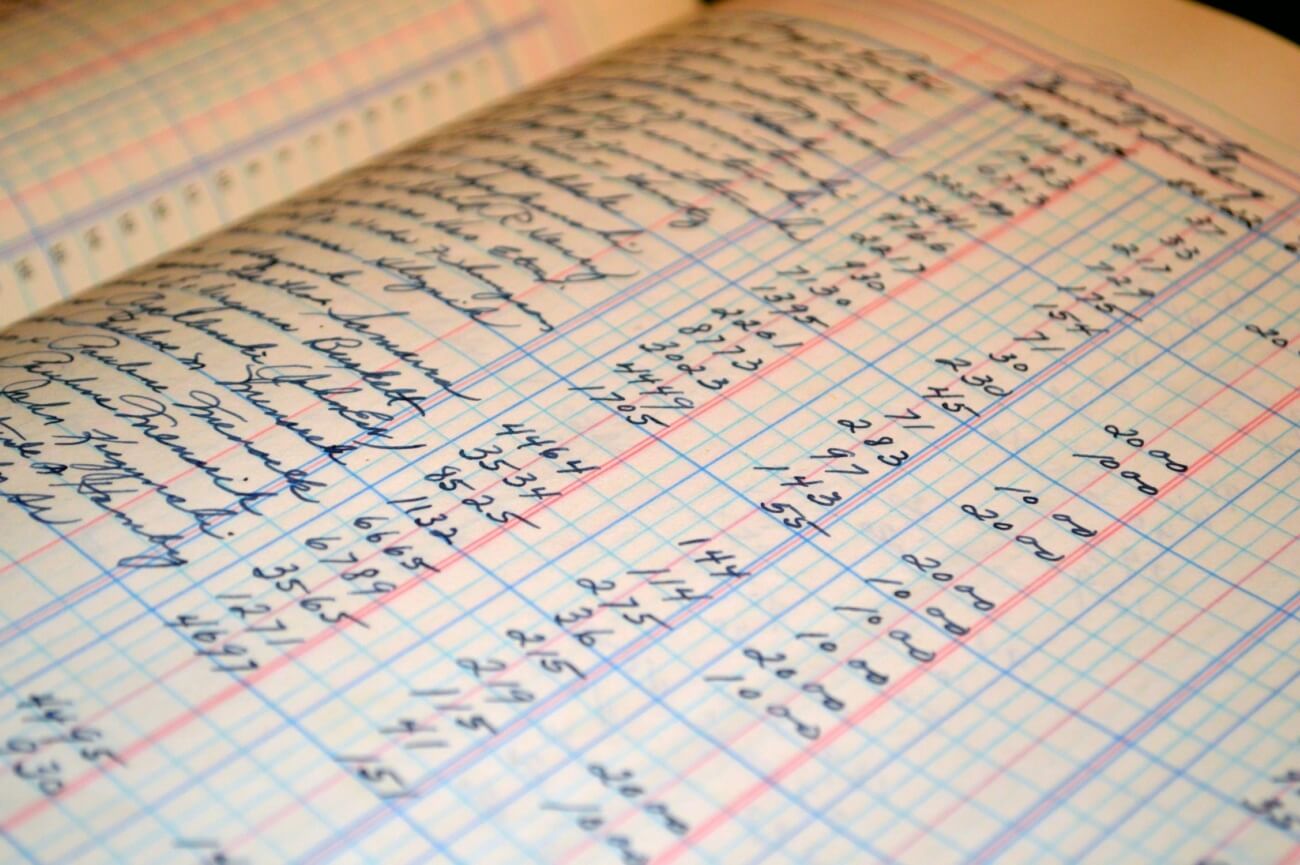

Sometimes, essential tax records are missing or even destroyed. But all is not lost, as there is a “plan B” that can be put into

Gone are the days of having to print your electronic declaration form when its emailed to you, sign it, scan it and email it back.

Deductible work-related expenses are always tempting to chase down, but to stay out of trouble with the ATO it’s always good to have fact sorted

Property developers often feel the gaze of the ATO on their activities, so we look at what could be getting its attention. Still on residences,

Heading overseas for that trip of a lifetime? There could be a few simple steps you can take to ensure all is in order tax-wise,

A recent tax case before the Federal Court serves as a reminder that a

Welcome to the December edition of our client newsletter. As the year comes to

Welcome to the November edition of our client newsletter. This month, we’ve brought together

Thinking about using your SMSF to invest in property? With the right structure, your

P.O Box 121

Mount Eliza

VIC 3930

P.O Box 121

Mount Eliza

VIC 3930